irs unemployment tax break refund status

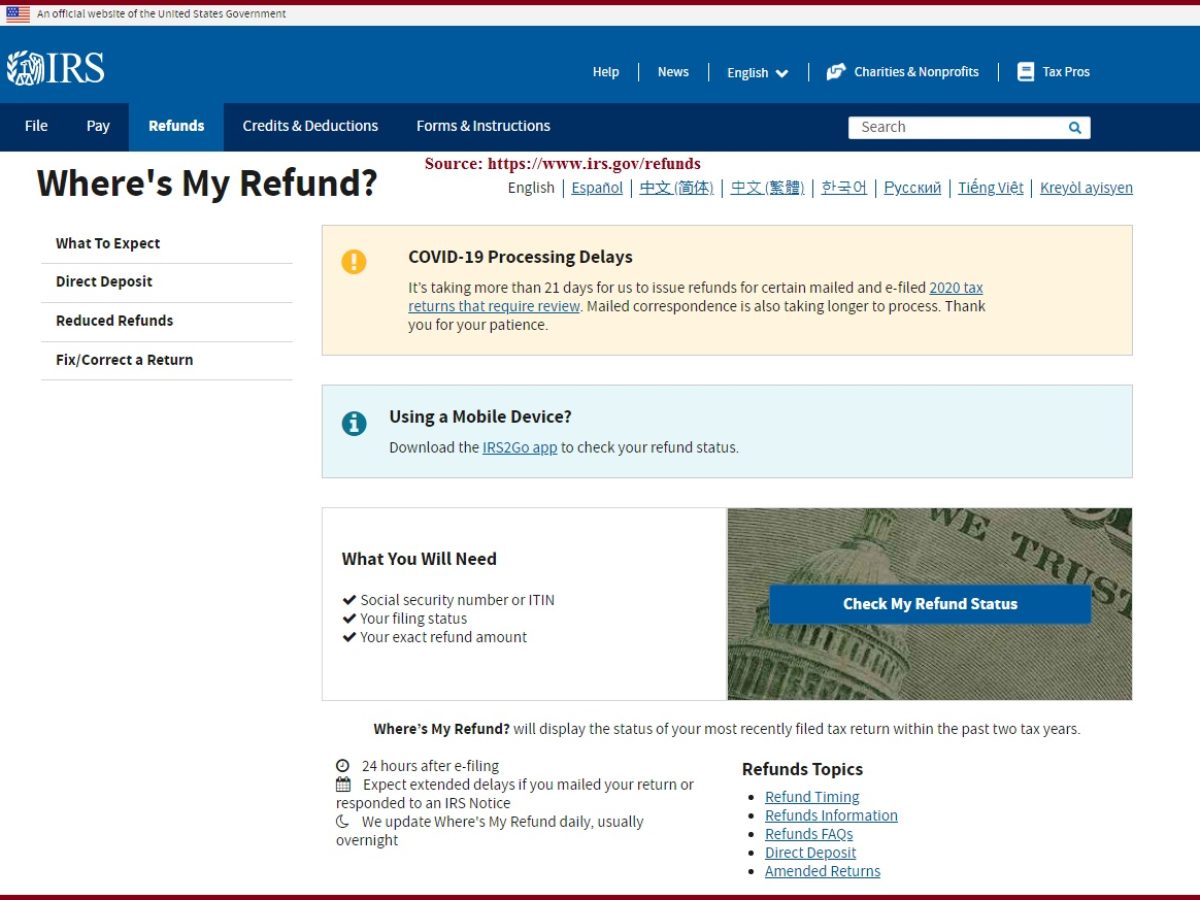

Check the status of your refund through an online tax account. The IRS is starting to issue tax refunds on up to 10200 of unemployment benefits received last year.

Your Tax Return Is Still Being Processed Irs Where S My Refund 2022

The bank info on here isnt even mine and I even called the bank and no account is open with bank number.

. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect. 4058 Minnesota Avenue NE Suite 4000. The tax refund for the unemployment compensation exclusion is being calculated and sent by the IRS starting in May and then throughout the summer months for all the taxpayers who are eligible.

My unemployment actually went to my turbo card. For married individuals filing a joint tax return this exclusion of up to 10200 applies to each spouse. The IRS has estimated that up to 13 million Americans may qualify.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. 22 2022 Published 742 am. About 7 Million People Likely To Receive Tax Refund On.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Irs Tax Refund 2022 Unemployment.

That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. Unemployment tax refund status. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. Unemployment payments are tax-free in some states such as California and some states are still subject to be taxed like New York. You may qualify for the tax break up to 10200 of unemployment compensation if your modified adjusted gross income MAGI is less than 150000 for 2020.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Those with past-due debt may not see any money.

The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. By Anuradha Garg.

If youre married each qualifying. Make sure to note your states rules and regulations on taxing unemployment benefits. Unemployment tax break refund status.

Unemployment benefits are subject to both state and federal income taxes. TurboTax receives no information from the IRS concerning any type of tax refund. Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system.

Thats the same data. TurboTax receives no information from the IRS concerning any type of tax refund. Check The Refund Status Through Your Online Tax Account.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. IR-2021-159 July 28 2021. Unemployment tax refund status.

Since may the irs has issued more than 87 million unemployment compensation tax. The agency had sent more than 117 million refunds worth 144 billion as of Nov. Thursday April 21 2022.

The IRS said this spring and summer that it would automatically adjust the tax returns for people who hadnt taken the 10200 exclusion into account when filing and would issue refunds in most cases although some would be required to file amended tax returns. What is the status on the unemployment tax break. And some states simply do not have a state income tax like Texas.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. DO NOT send cash or EMAIL THIS REPORT. If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your end.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. The unemployment tax break provided an exclusion of up to 10200. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

As of July 28 the last time the agency provided an update more than 10 billion. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. For individuals it excludes up to 10200 of their unemployment compensation from their gross income if their modified adjusted gross income is less than 150000.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your end. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

What are the unemployment tax refunds. Will I receive a 10200 refund. Updated March 23 2022 A1.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Tax Refund Irs The Motley Fool

Tax Refund Timeline Here S When To Expect Yours

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More Brinker Simpson

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sending Out 4 Million Surprise Tax Refunds This Week Wpri Com

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)